By Svea Herbst-Bayliss

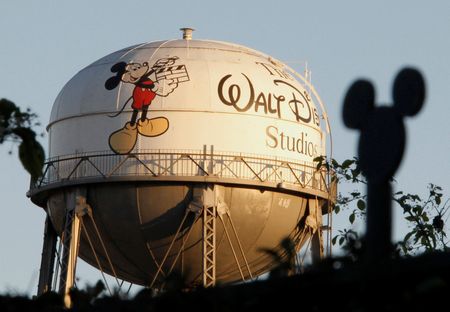

NEW YORK (Reuters) – Nelson Peltz’s Trian Fund Management returned nearly 3% in the first nine months of the year, investors said on Tuesday, as his bet on Walt Disney Co contributed to the activist hedge fund lagging its peers’ returns.

Disney’s stock price has tumbled roughly 30% since February, when Peltz ended a battle for a board seat but kept Trian invested in the stock.

Since the end of June, Peltz increased his ownership at Disney five-fold to a nearly 2% stake, worth $2.5 billion, people familiar with his portfolio said. Now he wants “multiple” seats, including one for himself, on the 11-member board, Reuters reported on Monday.

Beyond Disney, Trian’s biggest investments at the end of June included asset manager Janus Henderson Group Plc, plumbing and heating products distributor Ferguson Plc, and fast food chain Wendy’s Co.

Trian’s returns have historically been strong, with the firm returning an average 12% a year, an investor said.

Trian declined to comment.

Some blue-chip activist investors, including Bill Ackman’s Pershing Square Capital Management and Jeff Smith’s Starboard Value, are posting better numbers.

Pershing Square was up 11.7% through the end of September while Starboard was up nearly 10% through the middle of September, investors said. The average activist investor gained nearly 7% through the end of September, according to Hedge Fund Research data.

Pershing Square declined to comment and Starboard did not respond to a request for comment.

At the end of June, the average activist investor was up 11.5% while Trian was up roughly 6%, HFR data and investors said.

(Reporting by Svea Herbst-Bayliss in Boston; Editing by Nick Zieminski)