By Xie Yu and Summer Zhen

HONG KONG (Reuters) -Hong Kong stocks slid to 13-year lows on Monday and the onshore yuan fell to its weakest in nearly 15 years as global investors dumped Chinese assets after Xi Jinping’s new leadership team raised fears growth will be sacrificed for ideology-driven policies.

The Hang Seng index slumped 6.4%, recording its worst day since the depth of the global financial crisis in late 2008. Record foreign outflows via a trading link between the mainland and Hong Kong knocked China’s benchmark CSI300 Index down 3%.

Hong Kong-listed shares of tech giants Alibaba Group and Tencent Holdings Ltd both plunged 11%, dragging the Hang Seng Tech Index down 9.7% to a record low. Hong Kong-listed Chinese developers also plummeted 10.8% to record lows.

Both the property and tech sectors have been targeted for far greater regulation under President Xi, who secured a third term at a Communist Party Congress on Sunday.

International investors are “getting into the capitulation phase” where they “just don’t want to have the exposure”, said Andrew McCaffery, Fidelity International’s global chief investment officer, asset management.

The catalyst for the worry was the Communist Party Congress and the perception that there was not enough economic focus, he said.

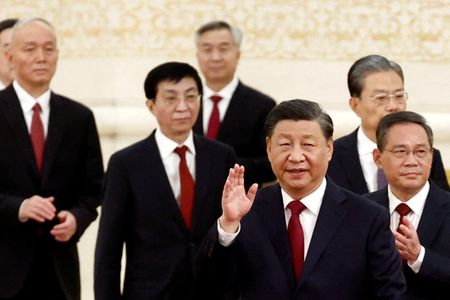

Xi secured a precedent-breaking third term following the week-long congress, and introduced the new Politburo Standing Committee stacked with loyalists.

The appointments showed China was moving “from economic pragmatism to political ideology”, said Ales Koutny, emerging markets portfolio manager at Janus Henderson Investors.

“The message here is clear: COVID Zero lockdowns, shared prosperity agenda and sectorial crackdowns are not going anywhere,” he said, adding that he believed these risks would limit China’s annual economic growth to 2-3%.

China’s gross domestic product (GDP) rose 3.9% in the July-September quarter year-on-year, official data showed on Monday, rebounding at a faster-than-expected pace but that was not enough to cheer investors.

FOREIGN OUTFLOWS

Stocks declines were relatively moderate for mainland markets, which are less vulnerable to foreign selling and were bolstered by a surge in Chinese defence-related stocks as investors bet geopolitical tensions, particularly over Taiwan, would intensify.

Foreign investors sold a net 17.9 billion yuan ($2.47 billion) of Chinese onshore shares via Stock Connect on Monday, the biggest outflow since the scheme was launched in 2014.

China’s bluechip CSI300 index lost 2.9%, while the Shanghai Composite Index dropped 2%.

Onshore yuan fell to its weakest level in nearly 15 years. Offshore yuan, in which trade began from 2011, slipped below 7.30 per dollar in late afternoon trading to a record low.

“The short-term negative factor remains China’s extremely harsh COVID policies, which have hit foreign investors’ confidence toward China,” said Yuan Yuwei, fund manager at hedge fund house Water Wisdom Asset Management.

Ravaged by the zero-COVID policy, which seeks to stamp out all outbreaks and has resulted in frequent lockdowns, sectors such as tourism, leisure as well as hotel and catering saw steep declines.

COMMON PROSPERITY

During the Communist Party’s 20th Congress, Xi reaffirmed his Common Prosperity drive, vowing to distribute income more fairly, and “standardise wealth accumulation mechanisms”.

He also emphasised national security, saying China should secure supply chains, sufficient grains and energy as well as work towards technological self-reliance.

An amendment to the Communist Party’s constitution enshrined “developing fighting spirit, strengthening fighting ability”, while a call to oppose and deter forces seeking independence for Taiwan was included for the first time.

With investors dumping internet companies and property developers, some of those funds were re-directed into chipmakers, high-end equipment producers and defence stocks.

Minyue Liu, Greater China investment specialist at BNP Paribas Asset Management, said that her portfolio has reduced its exposure to stocks vulnerable to an increase in geopolitical risks, favouring instead shares related to tech innovation, industrial upgrades and energy transition.

Fidelity’s McCaffery said the panic selling could be overdone.

“You’ve got to divorce current fear factors of the international investors … with the reality that’s occuring in the Chinese economy,” he said, noting that China’s efforts to promote strategic industries, increase infrastructure spending, and tackle climate changes created investment opportunities.

($1 = 7.2535 Chinese yuan)

(Reporting by Shanghai and Hong Kong newsroom; Editing by Edwina Gibbs)