By Chris Taylor

NEW YORK (Reuters) – If your kid happens to be in public school in Portland, Dallas, Los Angeles or Oakland and is taking a personal finance workshop in the coming months, ask them if they caught sight of one of the founders of the program.

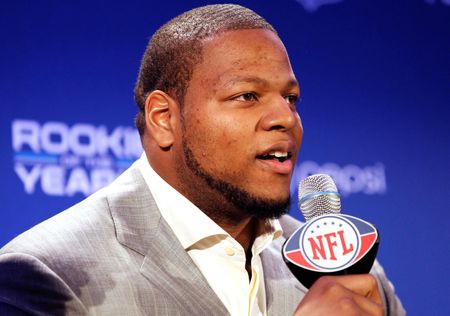

If he is 6-foot-4 (1.93 meters), more than 300 pounds and looks like a National Football League defensive tackle – that is because he is one.

That would be Ndamukong Suh, 36, an American football star who strikes fear into the hearts of opposing teams. As much as Suh enjoys sacking quarterbacks and tackling running backs – his Philadelphia Eagles are on a playoff push hoping to reach the Super Bowl – there is something else he enjoys just as much: Teaching children about financial literacy.

“They need to understand how to take care of their finances,” said Suh, whose Suh Family Foundation, with wife Katya, is partnering with the firm Intuit Inc to bring personal finance curriculum to schools around the United States. “Especially in marginalized communities, this can be a tough conversation to have, so I want to bring some light to it.”

Some NFL players and other well-paid professional athletes run into money troubles after their playing careers end. Indeed, when young players suddenly come into millions of dollars, without a lot of financial education, amid high-spending lifestyles, with agents and managers and entourages all taking a cut – the money can go away much more quickly than one would think.

In contrast, Suh, 36, has been mapping out his post-football life for years. He traces his money savvy back to his childhood in Portland, Oregon, and his parents – his mother was a teacher, his father was an engineer. As a kid, he would go to job sites with his dad, doing odd jobs like sweeping and cleaning, while his mom would give him $10 or $20 to cut lawns in the neighborhood.

In fact, it was his mother who first introduced him to the importance of credit scores, by adding him as an authorized user to one of her cards, in order to build his own record.

“When you get to the NFL, one of the first things they do is help you run your credit – and my score was almost 800,” an exceptional credit score, Suh said. “That was all thanks to the lessons my mom gave me.”

It is a long way from those early beginnings to his current line of work, where his biggest contract averaged more than $19 million a year, according to sports financials site Spotrac.

But Suh did fall into a typical money trap early in his career, spending more than he should have.

“Most athletes make the mistake of looking around the locker room and comparing themselves to other guys,” Suh said. “You see veterans with their Mercedes, and end up living beyond your means. Personally I made the mistake of going out to nightclubs and spending $25,000 to $50,000, versus taking that money and investing it.”

After those missteps he became more thoughtful about building wealth for his family, and – knowing that in the NFL, “your career could be over at a moment’s notice” – has worked diligently at building his own empire.

That has included starting his own real estate development company, with multiple projects completed and more underway. He also steers an investment portfolio under his House of Spears Management, owns several restaurants and is a fan of private equity, which includes working with famed VCs Andreessen Horowitz.

His business decisions and his charitable work – everything from providing scholarships at the University of Nebraska, his alma mater, to helping victims of domestic violence in Tampa – are undertaken with the help of his wife.

“I would say she is more risk-averse than I am,” Suh said with a laugh. “She pulls me back on some investments, and says, ‘Hey, maybe we should wait and see.'”

His financial literacy curriculum for kids includes hitting all the basics – spending, saving, taxes, budgeting and investing. It is his hope that beyond the current target cities, the money smarts initiative with Intuit will go global.

Suh’s main advice for kids?

“Keep it simple: Spend only what you need, and save the rest,” he said. “Learn to create and grow generational wealth, which I what I’m trying to do for my twin baby boys. And don’t be afraid to ask for help, or seek mentorship. Like my mom always taught me, ‘Don’t be afraid to ask questions – and there are no stupid questions.'”

(Editing by Lauren Young and Will Dunham; Follow us @ReutersMoney)