By Sabrina Valle

HOUSTON (Reuters) -Hess Corp on Thursday said drilling results expected this month could add a seventh platform in Guyana, which would lift the nascent oil producing nation’s output above the 1.2 million barrels of oil equivalent per day planned.

The U.S. oil producer is part of the Exxon Mobil Corp-led consortium that controls all production in the tiny South American nation. The group has confirmed so far plans for six floating production vessels in the country, home to the world’s largest offshore discovery in more than a decade.

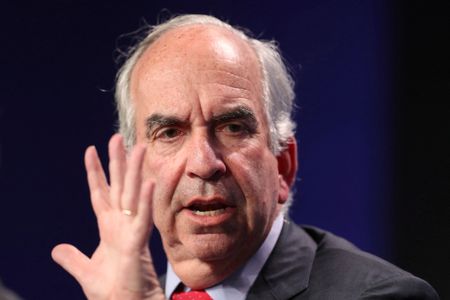

The 2022 Fangtooth offshore oil discovery is big enough to potentially require a platform for itself, which would be Guyana’s seventh, Hess Corp Chief Executive Office John Hess said in a conference by Goldman Sachs.

Results of appraisal wells at Fangtooth, located 11 miles (18 km) northwest of the first producing field in Guyana, may be disclosed as soon as later this month, he said.

Hess uses more aggressive output projections than its operating partner Exxon for the six platforms both companies confirm: 1.2 million barrels of oil equivalent per day (boepd) by 2027. Exxon estimates 850,000 boepd in its presentations.

Guyana currently has two operating platforms producing more than 360,000 barrels per day of oil. A third Exxon production vessel is planned to start pumping oil at the end of this year. Its construction in Asia is 93% complete, Hess said.

While six platforms have been confirmed for Guyana, the partners have sanctioned investments for only four so far. A final investment decision for the fifth platform, for the Uaru discovery, is expected for this year, he said.

Exxon, Hess and Chinese partner CNOOC have estimated 11 billion barrels of recoverable oil in Guyana, a number Hess deemed conservative.

“There are multi billion barrels remaining,” Hess said on Goldman Sachs’ estimate of 20 billion barrels of reserves.

(Reporting by Sabrina Valle in Houston, additional reporting by Liz Hampton in DenverEditing by Marguerita Choy)